Restaking: Risk / Reward Management

Similar to our risk index framework for DeFi protocols, we propose a rubric for evaluating restaking opportunities to help restakers make informed decisions with a clear view of risks and return profiles.

Using this risk management framework as a foundation, we are excited to announce that Re7 Labs will be launching a new vault for a liquid restaking token in collaboration with Mellow and Symbiotic.

Staking basics

Staking is a process where individuals participate in a proof-of-stake (PoS) blockchain network by locking up their tokens in a wallet to support the network operations, such as validating transactions, securing the network, and adding new blocks to the blockchain. These individuals, also known as validators, are typically rewarded for their efforts and investment with additional tokens.

Restaking, on the other hand, is a newer concept that allows for the extension of the security and validation services to other networks. This practice essentially permits a validator to delegate their staked tokens to another network without having to provide additional capital. This means they can earn rewards from multiple networks while only staking their tokens once. This concept is similar to rehypothecation in traditional financial markets. While no leverage is involved in the case of restaking, it does layer on additional risks as stakers are now subject to the rules and potential penalties of multiple networks.

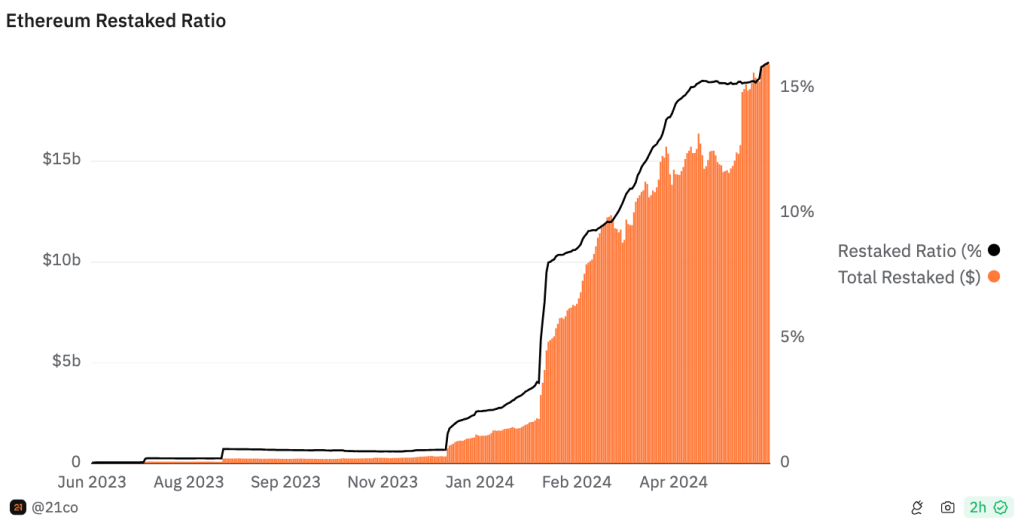

Compared to original ETH staking and the transition of Ethereum to a Proof of Stake network, the speed of growth in restaking is enormous.

The first restaking protocol, EigenLayer, has amassed almost $20 billion (yes with a B) in deposits. Now other restaking solutions are coming online, like Symbiotic and others which are building on the model and pushing further innovations.

It’s a good thing that risks haven’t stopped anyone in DeFi before. Or is it?

Staking and restaking: risk and reward

As a staker you are running a computer program in order to secure a network. You put up capital like ETH to participate in a network by validating transactions. In return you get a yield. Usually this comes in the form of transaction fees.

But this isn’t a risk-free yield. If you do not correctly perform your job, whether intentional or not, you will get “slashed” by the network, loosing some portion of your staked capital.

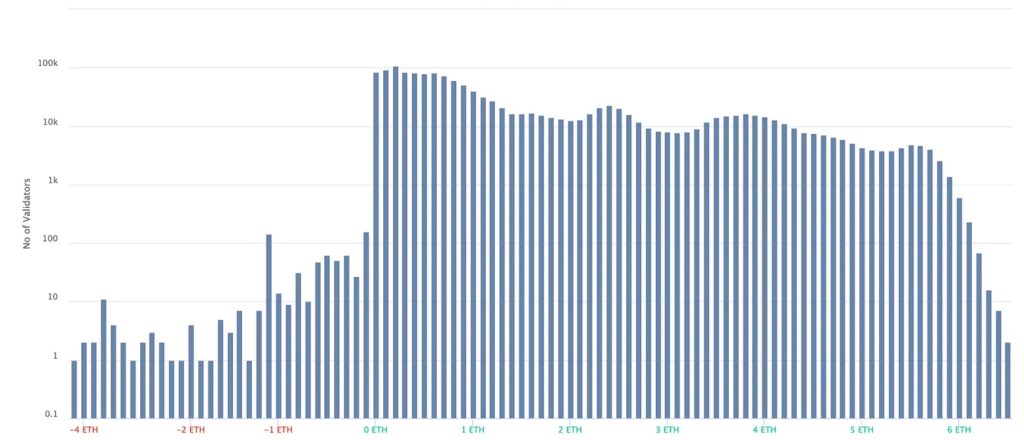

The income distribution chart for Ethereum stakers is instructive here. Per 32 ETH staked, many have made acceptable or even impressive returns. Variability on the high end is uncertain. Meanwhile, some validators are down bad. A single slashing can ruin a validator’s return profile.

These are not theoretical risks. There have been hundreds of slashings so far in Ethereum. Average expected loss is somewhere around 1 ETH, almost an entire year of income for the validator. And yet such estimations fail to account for long-tail risks that could have worse outcomes.

The potential rewards can be lucrative. The largest block rewards on Ethereum have been in the hundreds of ETH. However these returns are highly variable and average ETH staking yields have ranged around 3-4 %. Restaking could push this up meaningfully. In addition, airdrops and other rewards can be counted towards the expected long term yield for staking.

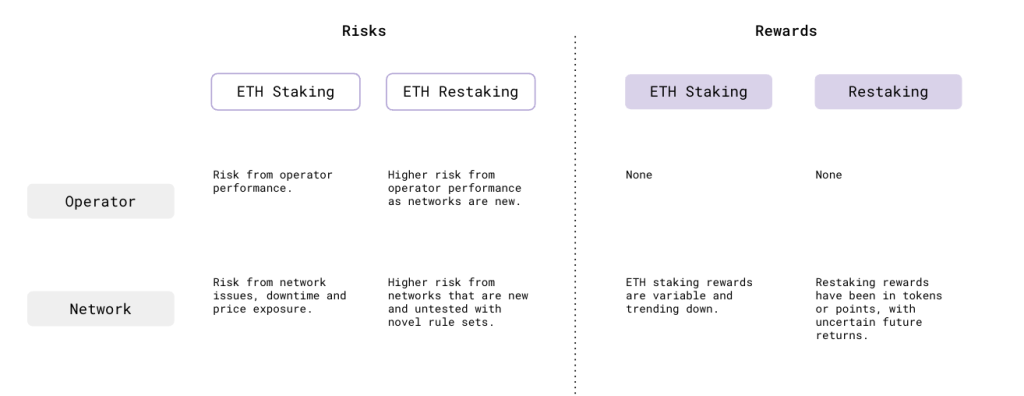

With the advent of restaking, a new facet of possible return has opened for stakers. Of course this brings with it new risks.

By letting ETH stakers delegate to other networks, restaking lets networks share in ETH’s security. In practice this will mean running additional node validating software and opting in to the network’s rules for slashing.

The benefit is that stakers don’t need to put up additional capital, making it cheaper for networks to bootstrap security. Restakers get another source of yield. The potential downsides are similar to those for staking, but for new and untested networks with different sets of rules.

Modular risk management

Further maturation in DeFi architectures has lead to increased separation in roles.

The move is from vertically integrated protocols that manage all aspects of a system to a modular system where specific actors perform roles in their areas of competence.

The results have been showing in some basic DeFi legos like money markets, where Morpho Blue and Euler are simplifying the base primitives and to allow risk curators and other protocols to easily build on top.

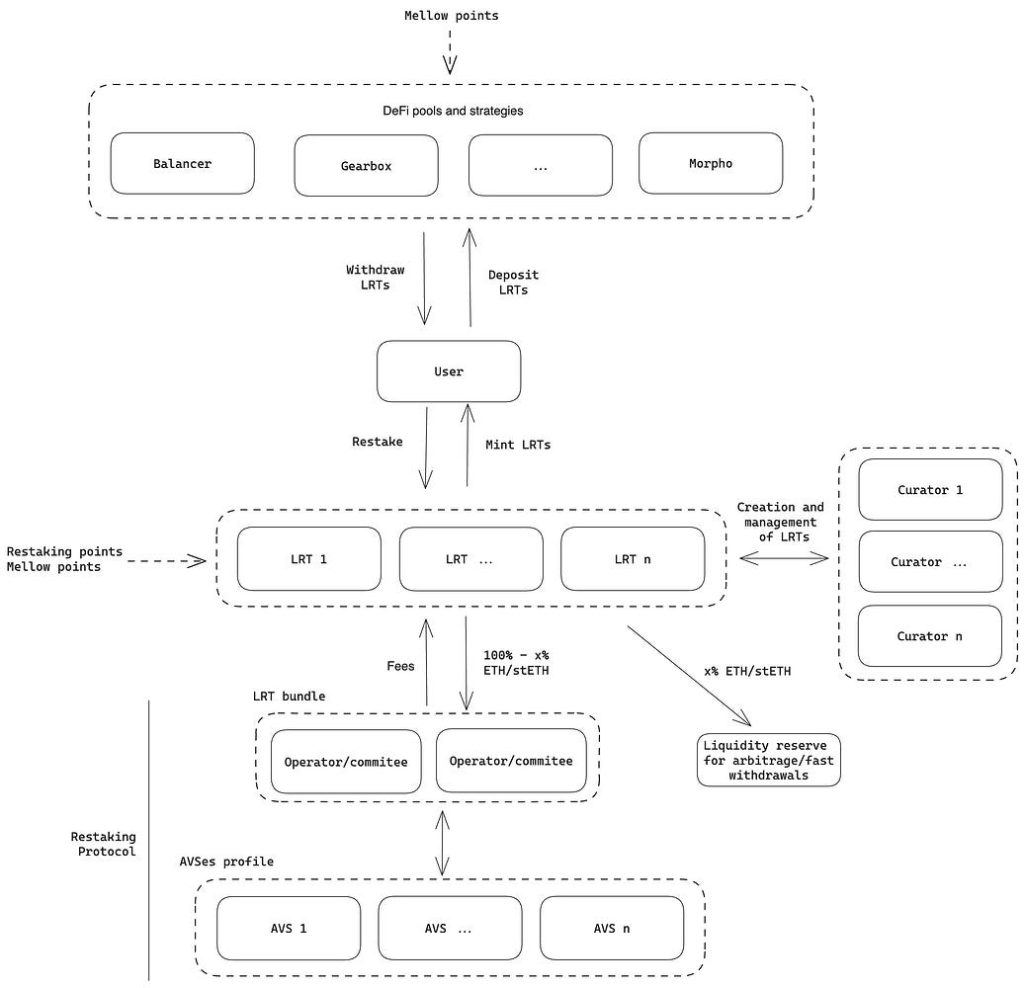

The same model comes through to restaking with LRTs (Liquid Restaking Tokens) and even further layers of abstraction like Mellow. Mellow creates a simple vault structure on top of restaking delegation, allowing users to customize their own risk profiles and an associated Liquid Restaking Token that can be used in DeFi.

So then the question becomes, for all actors in the restaking ecosystem: how do we quantify and manage potential risks to these systems.

The Risk

With the basic models understood, we can begin to craft a framework for evaluating the risk and returns from providing shared security to another network.

Operator risks

There are risks associated with each operator, the ones running node software beholden to a network’s rules.

Extended downtimes, failed upgrades, software bugs, security lapses and other eventualities will arise that can lead to slashing or other loss of funds.

Each operator will have different process, certifications, and risk mitigation in place. Some may offer insurance or performance guarantees that can impact expected loss.

Operators can also act dishonestly. Already some validators for Ethereum have been indicted for intentional manipulation on the protocol. Basic negligence is a more likely risk when it comes to professional validators, but the risk is long-tailed and not always perfectly observable.

Until there is a longer track record of operator performance, stakers will need to review the technical and operational risks inherent in running validator nodes. Mitigation through ensuring operators have good reputations and clear processes is important.

Network risks

Sharing security with new networks will necessarily carry additional risk. Each will have its own rules for validators. Many will be running with new and untested client software.

Bugs in the network or particular clients have already caused slashing events for ETH stakers. We can assume there will be similar events for new networks. Thinking through each network’s slashing rules and relevant scenarios for loss will be a necessary task for restakers.

Similar to operators, until there is a network track record, it will be difficult to evaluate the exact risks behind restaking. To start, there are basic and attentive ways to monitor and manage these risks. Services that report on network health like HyperNative and collating data across multiple restaking services is likely to help provide further data to make evaluations as networks grow.

Centralization and correlation risks also can impact these new networks. For example, concentration of stakers can introduced risks for correlated slashings because of issues with a single validator. Stake that is being distributed and used in DeFi through LRTs can have knock-on effects from hacks or depegs.

All of these can impact the network, and introduce additional risk and open up to slashing for validators. These are all heightened on new chains with untested mechanisms, rules and less staker diversity.

Yield volatility

Beyond areas for loss, there is the potential for upside and the added yield this provides.

To date, the expected returns from restaking have come down to future-expected value in the form of token airdrops from restaking projects and other networks looking for shared security.

Already a meta is forming where networks will look to provide a portion of their tokens and upside to restakers as a direct economic incentive. This is to increase staking rewards, which for now and the short-term are going to be negligible. A recent exercise by DeFi Llama’s 0xngmi showed that potential expected returns for a wildly successful BTC bridge network using restaking could be as low as 1.5 bps.

These problems look very similar to those we encounter in our Liquid Token Fund, where we have honed techniques like network data profiling to create data-backed models for future value.

We expect the economics to work themselves out over time as more networks come on line and use cases are explored by the community. But in the meantime, restakers will need to evaluate the potential upside for participating in new networks.

Opportunity costs

Not all networks will be created equal, and delegating to some networks will be sure to be more lucrative than delegating to others. We can expect the points and airdrop farming meta will carry on for a while still. Restakers will soon face a dilemma we are familiar with as DeFi operators: whether to allocate to positions with extremely high current yield but lower long term prospects, or to positions with long term prospects but potentially lower yield.

In ideal world, all networks would be high yielding and expected-value positive for restakers. The reality is that upside will be unevenly distributed and restakers will have to make “portfolio management” decisions about where to delegate their capital.

A risk framework in process

We can expect the volume of restaking opportunities to increase, and this will require a structured process for intake and evaluation of these options.

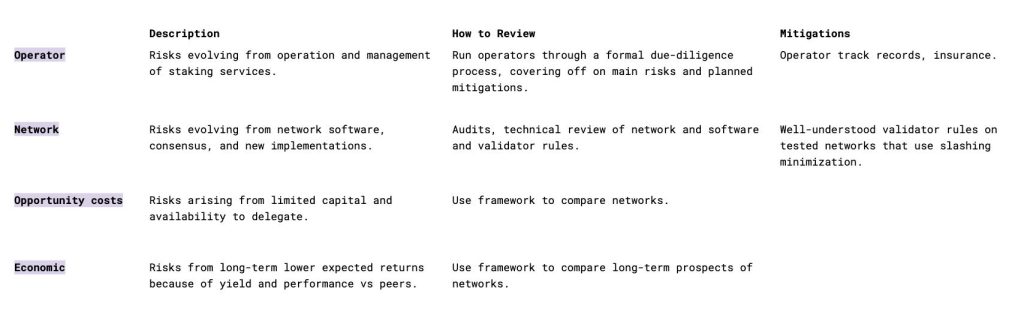

We propose a risk-framework with the categories above. In our internal ratings, sub-categories and specific points of due-diligence are added to create composite risk-reward scores.

We have seen this first hand in our DeFi portfolio, where the universe of potential positions grows by the day.

Establishing a framework for “grading” networks for their potential risk and return is a first step. In practice there is far more needed to make use of this within a larger process.

No restaking solution has enabled slashing yet, but soon real money will be on the line. Ahead of this, many conversations around restaking risks and returns have relied on theory to predict the eventual outcomes and optimal decisions. We think that the risks represented by restaking share clear problem space with risks we have evaluated for years as DeFi operators. Navigating potential risks from technical to operational to economic has been the daily work of Re7 since launch. By taking lessons from this practical experience, there is a solid framework for weighing the risk return of these new systems.

Announcing Re7 Labs LRT Vault

DeFi and restaking require discipline, focus and strong partners.

Symbiotic is a pioneering restaking protocol that enables shared security across multiple networks. Mellow is an innovative protocol that creates a vault structure, simplifying the restaking process and allowing curators to customize risk profiles for their users. Both protocols, with their combined strengths, make a perfect fit for our initiative as they provide robust, secure and user-friendly platforms to start our restaking endeavours.

This collaboration allows for new methods of building on top of restaking that will allow vault curators to create modular LRT architectures that delegate across various networks. Our aim is to unlock the benefits of restaking and DeFi composability of LRTs, while taking a practical view towards reducing risk.

Re7 Labs

Re7 has been providing liquidity in DeFi since 2019 deploying capital over across yield strategies and liquid venture investing. As DeFi-native managers, we have focused on providing early liquidity to various DeFi protocols to help grow the ecosystem.

Re7 Labs is the innovation arm of digital asset investment firm Re7 Capital, taking the practical experience of DeFi risk management to on-chain vaults built on top of protocols like Morpho and Mellow.

We are open to collaborating with restaking protocols that are looking to implement robust risk management frameworks – you’re welcome to reach out on Twitter.

P2P.org Curated Restaking Vault

P2P.org is a non-custodial staking and restaking provider with over 10,000 delegators and nominators across 50+ networks. Launched in 2018, P2P.org aims to shape a decentralized future and maximize staking and restaking opportunities. With that in mind, we are proud to support the launch of the new Restaking Vault curated by P2P.org in collaboration with Mellow and Symbiotic.

We invite you to join us in this exciting new chapter. For questions or information, contact our team on our official Telegram channel or X-account

Twitter: @p2pvalidator Telegram: https://t.me/P2Pstaking