SocialFi – Are you Paying Attention?

The genie is out of the bottle.

Re7 believes that the on-chain financialisation of digital social interactions represents the next evolution of the creator economy – projected to grow 120x to $242B by 2030. Re7 is also looking to capture the opportunity better than anyone else.

When University student Amelia Dimoldenberg started interviewing deadpan Hip Hop artists inside a Chicken shop in 2011 for fun, she wondered whether it would be a ‘degree or YouTube that might eventually lead to a career for her’.

Today, Amelia’s Chicken Shop Date series has been viewed over 500m times, and interviewed every celebrity under the sun from Lando Norris to Jennifer Lawrence, on a date, inside a Chicken Shop.

The path to career ‘success’ in a digital-first world is becoming less standardised but creators globally are leaning into this reality rather than fearing it.

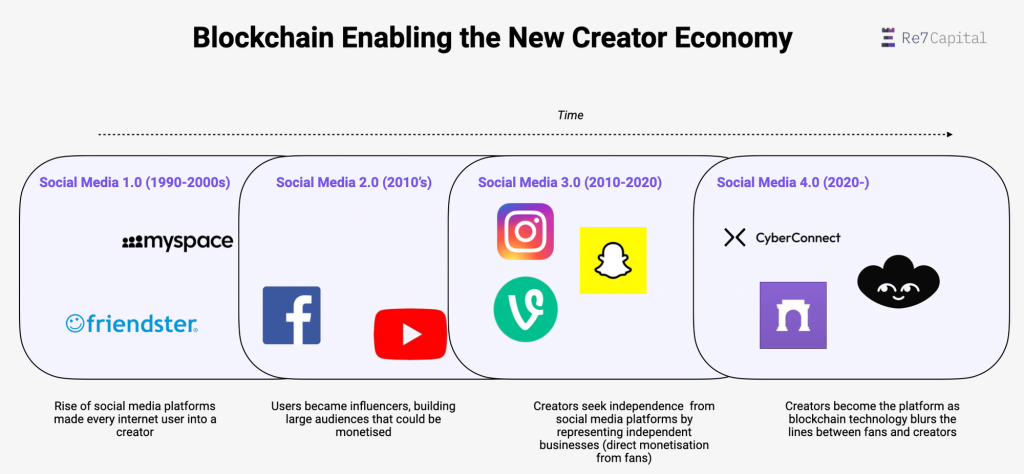

Over the past decade, the ‘Creative Economy’ boom, a $153B market today, has illustrated the leverage centralised platforms have in underpinning this economy.

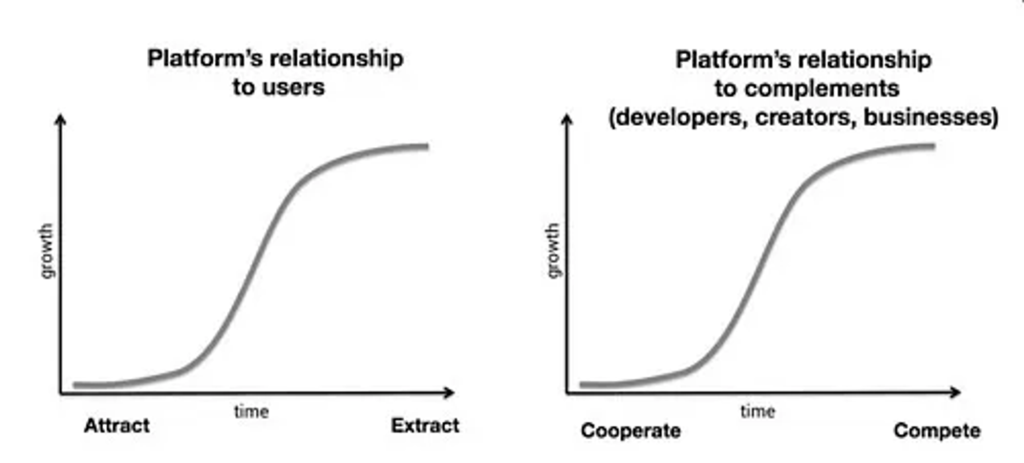

Web2 platforms shift from cooperating to competing with partners when user growth nears saturation.

As a result, creators have sought independence from centralised digital platforms by representing independent businesses that tap into their existing fan base. The stakeholder incentives have been misaligned for too long.

After reaching 1m Instagram followers, Cambridge University blogger Grace Beverley diversified her fan monetisation, founding fitness clothing brands, apps, and podcasts.

We believe this independence from centralised platforms will continue to its next logical phase – one where creators become the platform itself.

Social Media 4.0

Blockchains are essentially value-transfer systems.

The transparency, efficiency, trust, and security of value transfer are all being enhanced in some way through permissionless design.

As a result, they are helping to redefine what we mean by value ownership.

Blockchain offers a means for creators and fans to interact in ways not possible by legacy digital platforms.

The value of digital platforms lies in their social graph, rather than their feature set.

TikTok’s paper valuation of $180b is markedly different to Snapchat’s $23b despite both platforms sharing a wide range of features (e.g. feeds, live streaming).

The value derived from social graphs by centralised providers is being returned to users.

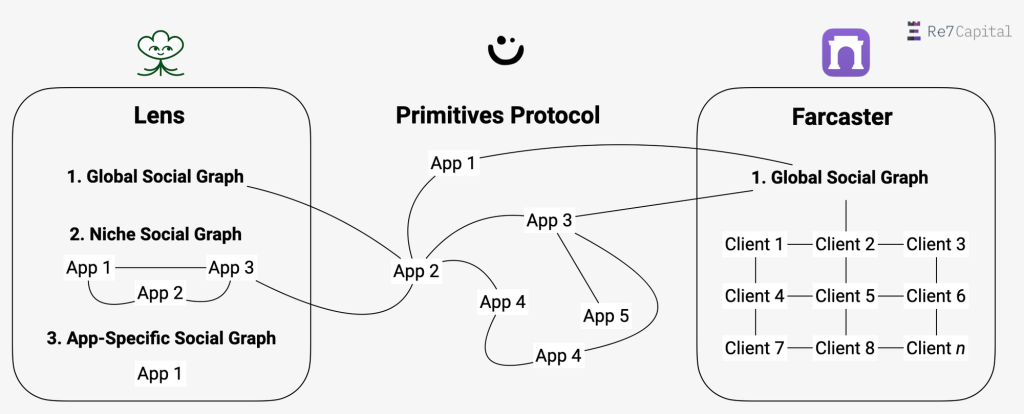

Decentralised social graphs like Lens and Farcaster enable users to find and communicate with one another more openly.

Their open-source approaches will also enable faster innovation from applications built on them.

“Leveraging open and modular social graphs unlocks unprecedented potential to transform and elevate the consumer experience.” – Kimmo Sirén, Co-Founder Orb

Removing rent-seeking behaviour fosters increased product and feature competition, creating sustained value for users.

This comes at an opportunistic time with the Creator Economy market size estimated to grow to 3x ($485B) by 2030.

Today, Re7 estimates the Web3 creator economy stands at ~$2B (1.3% of total creator economy market).

The Web3 creator economy can capture 50% of the total market by then ($242B) – representing a 120x growth in just 6 years (123% CAGR).

The creator economy opportunity is large. The Web3 creator economy opportunity is larger.

Attention Is All You Need

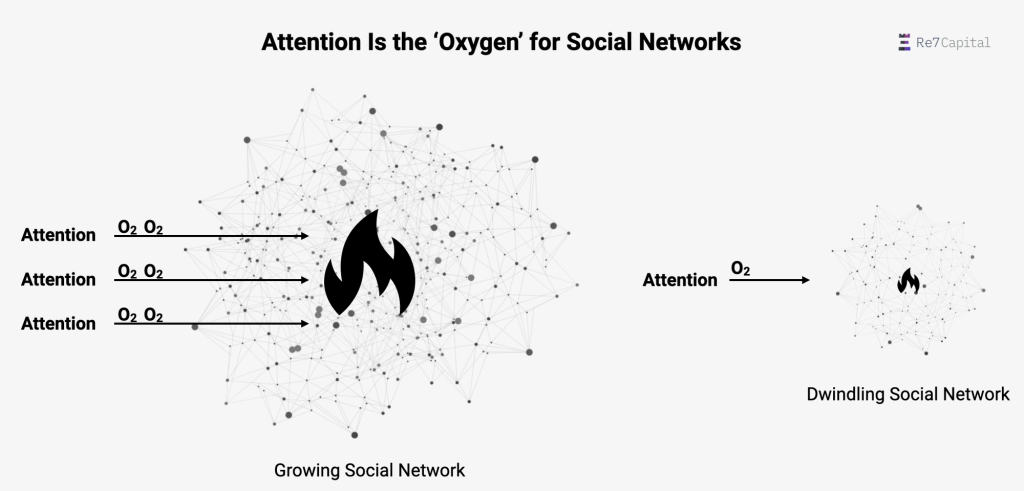

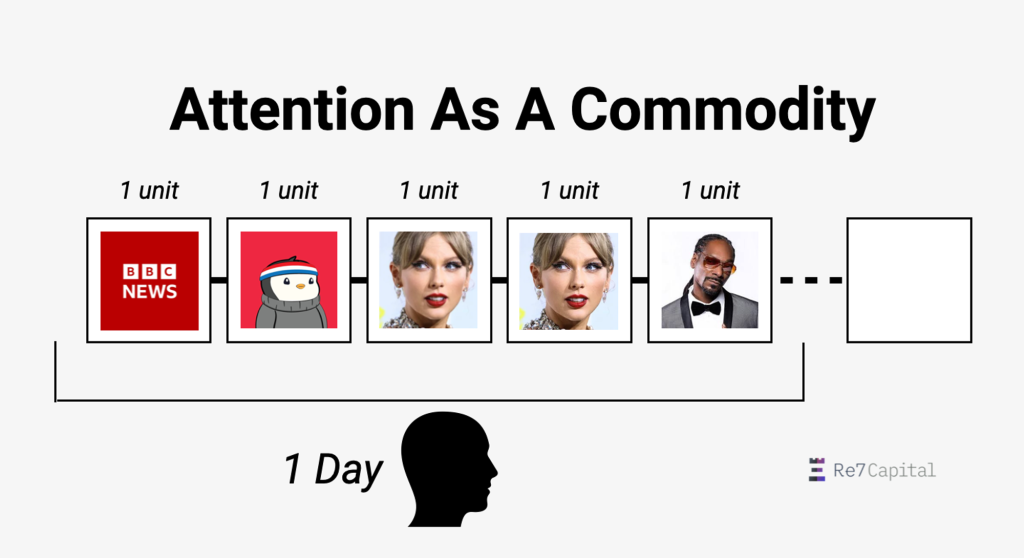

Thesis 1: Attention is the valued commodity as a finite resource

American economist Herbet A. Simon observed that:

“In an information-rich world, the wealth of information means a dearth of something else: a scarcity of whatever it is that information consumes.”

Human attention is zero-sum as a finite commodity.

It is the ‘oxygen’ that keeps social networks fire alive: take it away and the network dies, funnel more and the network proliferates.

A user spending time in an application becomes valuable as they could be spending time elsewhere.

As users can leverage their social graph across applications, exit costs become minimal. Applications must therefore compete to provide the best experience for their users.

Being open-source also means Web3 strives for a more “complete market” for attention.

Creators can work with a greater design space for how they capture value and analyse that attention over time.

For example, social graphs to be siloed by design (e.g. Lens). A news app built on Lens may choose to dichotomise its audience’s attention based on their political views.

However, a remaining challenge for Web3 Social becoming a fully “complete market” is the interoperability between social graphs. A content creator on Lens may want to leverage a valuable, growing social graph on Farcaster.

For this reason, we see new markets, like Social-Graph-as-a-Service, as enabling the composability between decentralised social platforms.

Protocols like Primitives create a unified social graph layer that can be interacted with by any existing social app using API calls and SDKs.

These layers will become more important in enabling a seamless flow of attention between apps, ecosystems, and communities.

Thesis 2: New monetisation models unlocked not possible by traditional social media platforms (open platforms used as public utilities)

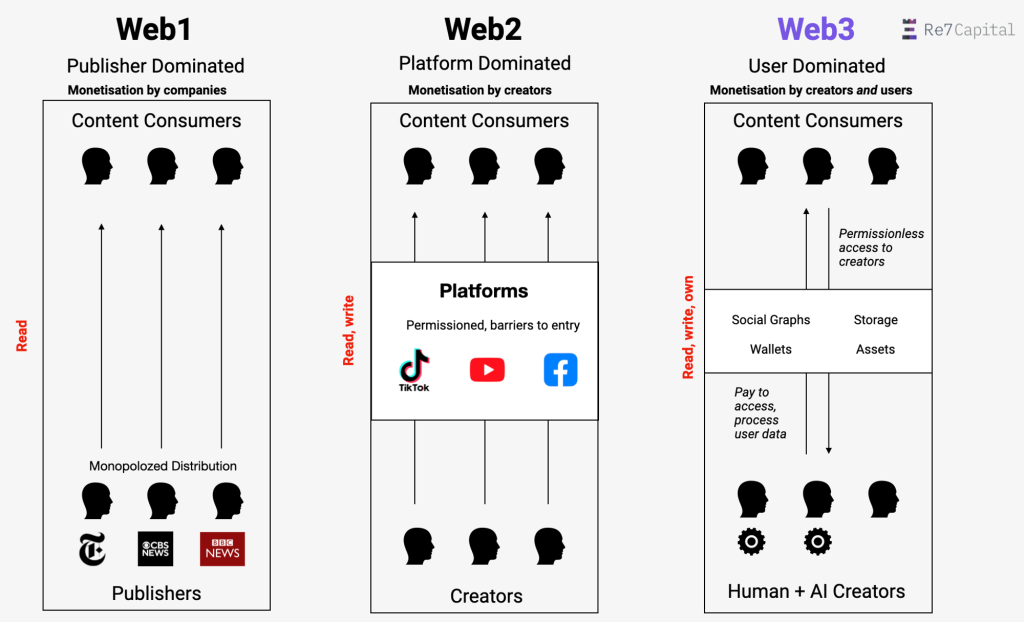

In Web3, social networks become user-dominated for the first time by having more control over the accessibility of consumers and data.

For the first time, monetisation opportunities between consumers and creators become bidirectional.

Earning through Attention

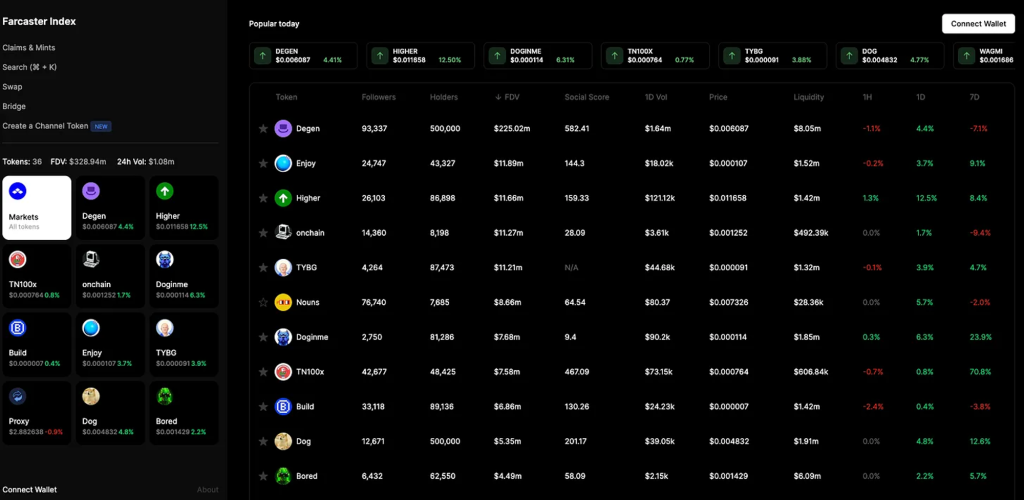

Financialising attention within the social experience is likely what ‘unlocks’ the Web3 social market.

The tokenisation of attention enables it to become the new digital ‘commodity’: one that can be ascribed value more precisely and becomes tradable.

The application of finance can be widespread, from in-messaging trading to marketplaces for social capital.

Through this lens, you realise social becomes the new frontier of DeFi (SocialFi).

Instead of trading assets on a DEX, a consumer can trade attention within social environments.

However, unlike legacy DeFi, the financialization of social interactions can drive specific behaviours between creators and consumers not seen before.

“Show me the incentive and I’ll show you the outcome.” – Charlie Munger

Creators

Creators can tokenise attention to bootstrap creator communities.

Some musical artists like Daniel Allan have used tokens to distribute ownership of future work.

Australia Rapper, Iggy Azalea is using memetics to financialise their fan base through tokenisation.

Web3 inverts the traditional online content creation model whereby creators can monetise and build an audience upfront with tokens. Any money can then be used to produce content, grow their business, and reward their consumers.

Some projects, like Time.fun, are tokenizing time itself where users can buy and sell minutes of someone’s time. Another example is platforms that offer gated means to chat with someone, such as Lunchbreak, where users can buy and sell passes for inbox access

Not only are creators able to connect more closely to their community, but they can also better monetise user engagement itself.

Creators can also leverage tokens as instruments to analyse and access their top stakeholders.

For example, exclusive content or VIP fan experiences could be committed to the largest and longest-standing token holders.

It’s not just existing creators that are tokenising communities.

We also see grass-root examples in Web3.

Degen, a network Re7 backed in February 2024, went on to meme its way to becoming a reward currency for content.

For Jacek (Founder of Degen), tokenising the Degen community to bootstrap growth was always the goal:

“Launching DEGEN allowed users from the Degen channel and beyond to seamlessly monetize their Farcaster reputation and engagement. Now, DEGEN offers all Farcaster users the opportunity to earn tips for posting high-quality content, providing a frictionless way to monetize their contributions and enhance engagement across the platform.”

It’s now the largest tokenised community that exists within the Farcaster ecosystem today.

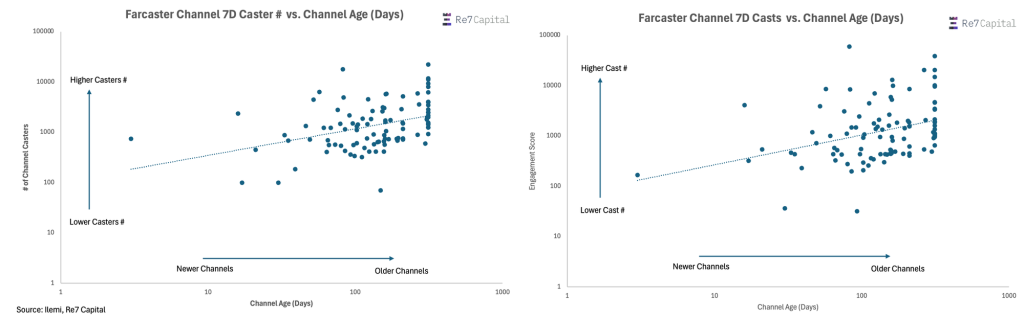

And creators can leverage the benefit of on-chain data to analyse audience behaviour. At Re7, our market intelligence tooling is already picking on emerging trends.

Older Farcaster channels normally see higher engagement KPIs than young ones.

Therefore it seems, that early communities have a first-mover advantage that can gain social momentum as competition intensifies.

This makes sense: as social networks get bootstrapped, competition for user attention between communities is relatively low vs. over time.

Building out a cultural network effect is easier when you can snowball attention at a time when there are limited competing channels for attention – a potentially important lesson for any creator.

Consumers

Consumers can earn based on the attention given to that consumption. For example, participating in financial games or contributing to social forums.

We’ve already seen a plethora of experimentation aimed at monetising attention.

Mini apps show how utilising the social layers where users already spend their time (e.g. TON) can expedite adoption.

Tap-to-earn TapSwap boasts 50m total users while Hamster Kombat saw >250m accounts playing its game in just a few weeks.

Creators forming incentives to drive specific engagement behaviours from their audience also create monetisation opportunities for the consumers for the first time.

Apps like Pods.Media allow podcasters to mint NFT collectables for their listeners who can support the channel financially.

Technology like Soulbound tokens could be leveraged today to help users track their rewards under one identity. Unlike in Web2, users won’t have to have 500 profiles for each app they interact with.

In the case of Pods.Media, podcasters can see more easily recognise their top fans.

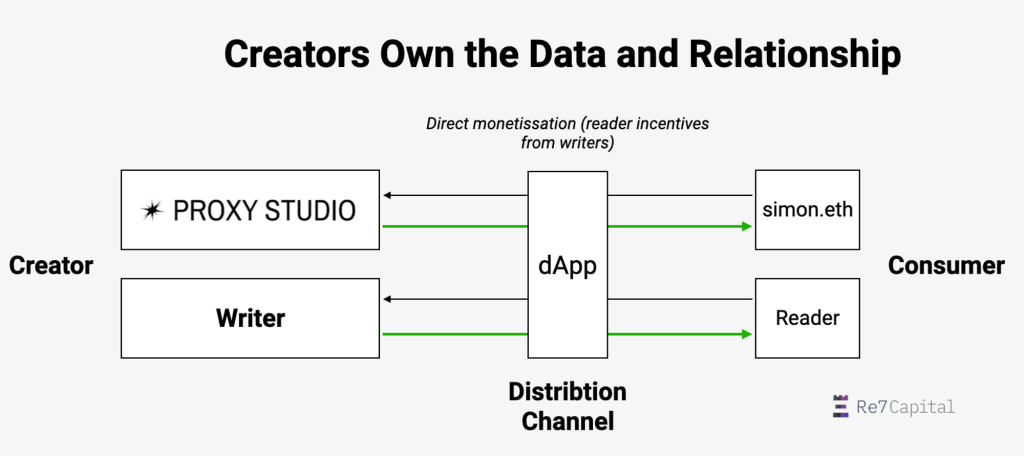

Proxy Studios, an open venture studio for Farcaster, tokenises access to their premium newsletter and embeds sign-up as a frame directly on Farcaster.

Monetisation opportunities can also be sporadic given the lower barriers to entry.

Platform users can also tokenise their content that has received measurable attention. For example, by minting an NFT collection. For example, content creators can use Lens’ Collect module to have consumers purchase content directly.

It’s easy to conceive a post commenter whose response turned into a viral meme sensation. That user could then tokenise that post which could be offered in the open market whereby every sale includes a royalty fee of 1%.

Consumers can easily become creators who can also own the distribution channel of their content, and even turn into sellers of commodities directly via their social feeds, such as via Frames on Farcaster.

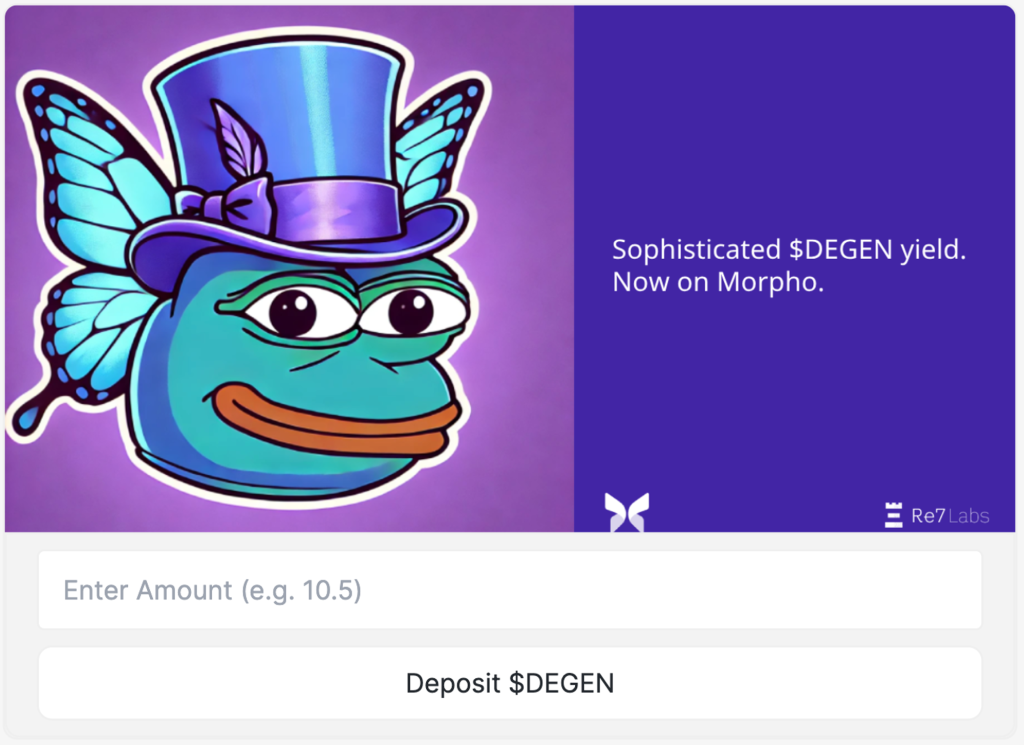

Finally, DeFi is also getting embedded into social experiences.

Re7 Labs, the innovation arm of Re7 Capital, runs lending vaults on Morpho and historically accessing them has only been feasible for DeFi-native users.

Now, Farcaster frames enable lending deposits directly from the social layer, e.g. depositing the $DEGEN community token into a Morpho lending vault.

Thesis 3: Capturing Value

With Web3 social, users consume content and apps that aren’t run by a single company that captures the value of attention.

This means value capture can be theoretically found in any product or service that creates, refines, markets, or tokenises attention.

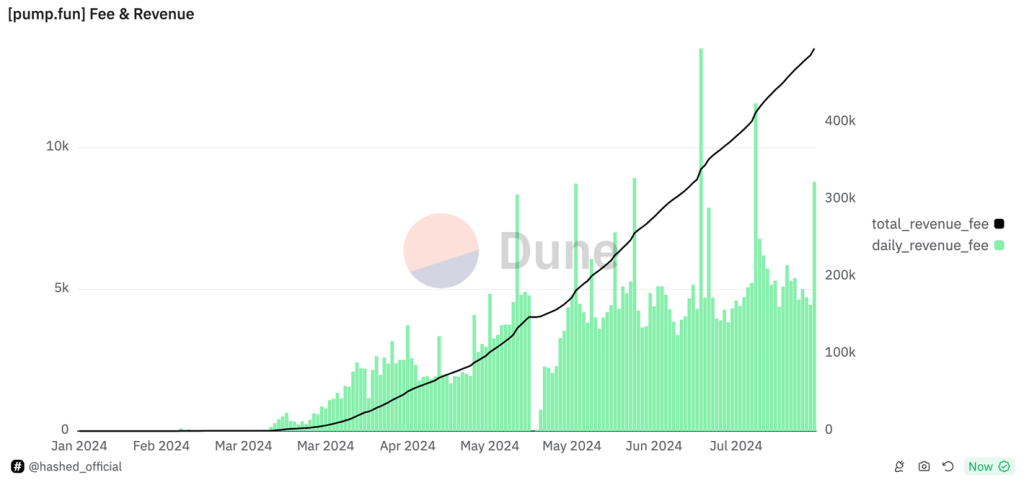

Pump.fun showed how making it easy for users to deploy tokens in a chance to capture global attention was an untapped, but lucrative market.

The platform has now earned >450k SOL($76m) in just over 7 months.

We are likely to see much more monetisation on the infrastructure side too.

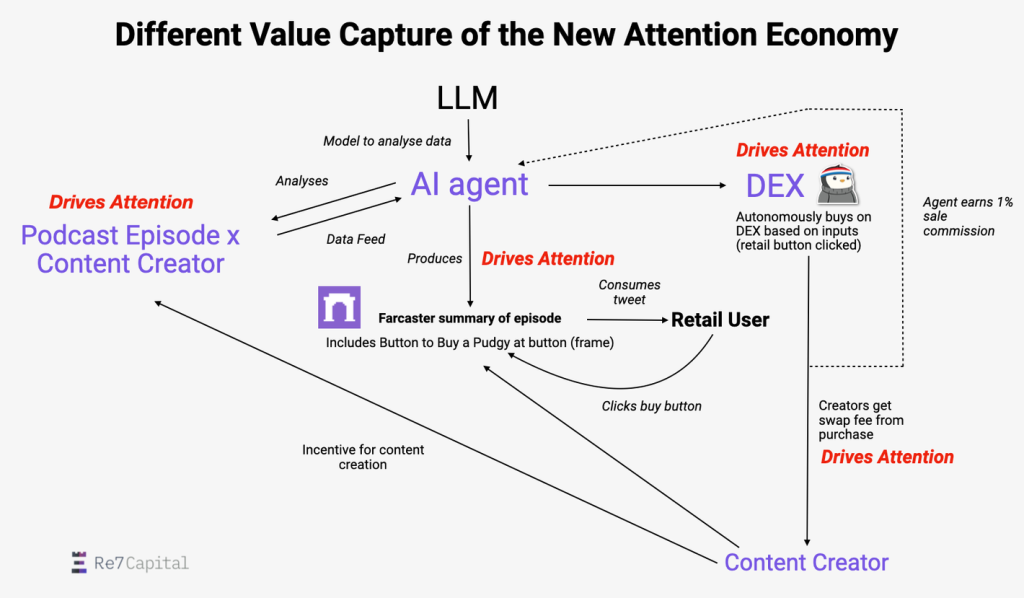

On-chain agents, who can perform tasks without human intervention, could scale attention further for content creators.

For example, take a content creator (Pudgy Penguins) who wants to scale attention to their target audience.

Monetisation opportunities across the entire attention flow could include:

- An AI agent – who analyses and summarises podcast content for retail users. Receives sales commission from content creators.

- Orb Clubs – tokenised on-chain channels/subreddits, rewarding quality content via embedded wallets

- A DEX – facilitates the trading of ‘attention assets’

- IP Creator – creators receiving swap fees, IP ownership

Companies or crypto networks that most effectively monetise attention will be able to capture value better at the equity or token level, respectively.

The Why Now

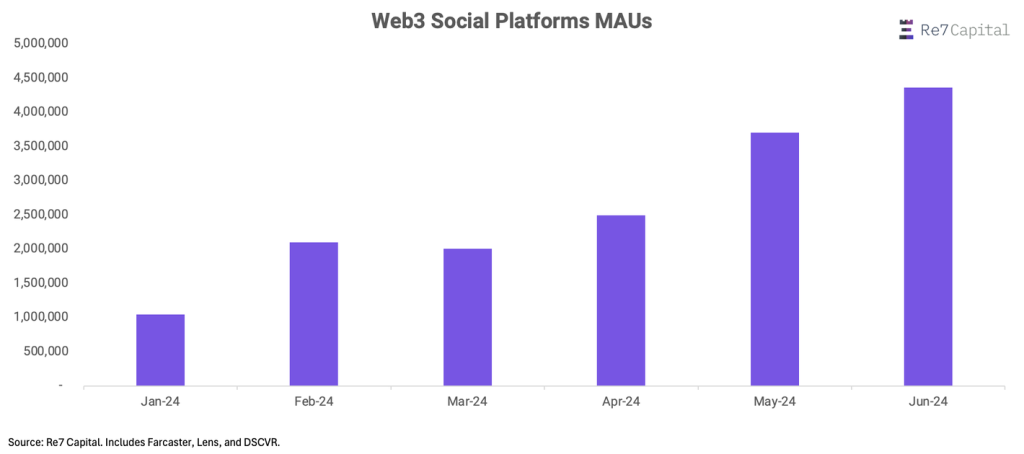

Web3 social networks are already seeing nearly 4.5m MAUs in aggregate – 4.5x growth in 7 months.

These numbers are still a far cry from Web2 social platforms, representing 1% of Snapchat, 0.5% of TikTok, and 0.2% of Facebook’s MAUs.

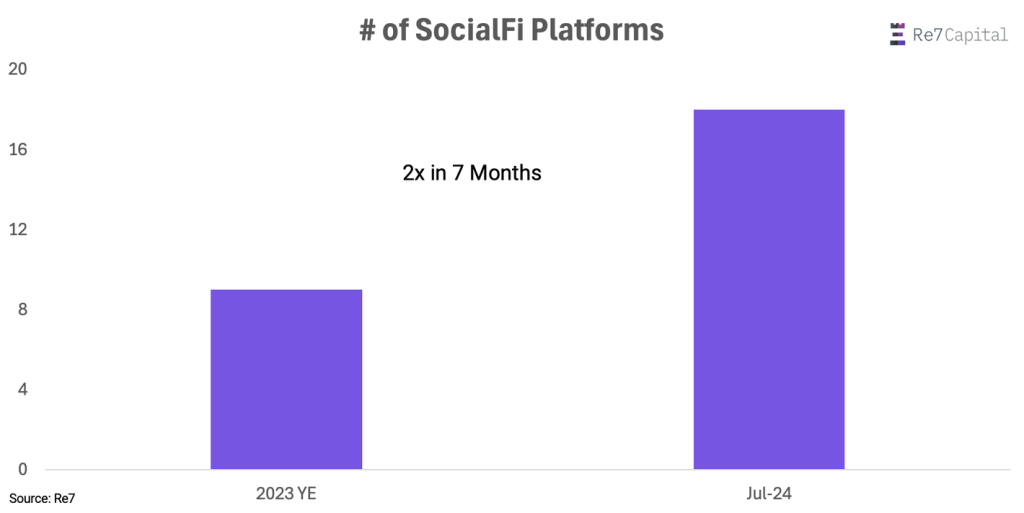

We’ve also seen the number of SocialFi platforms grow 2x so far in 2024 alone…

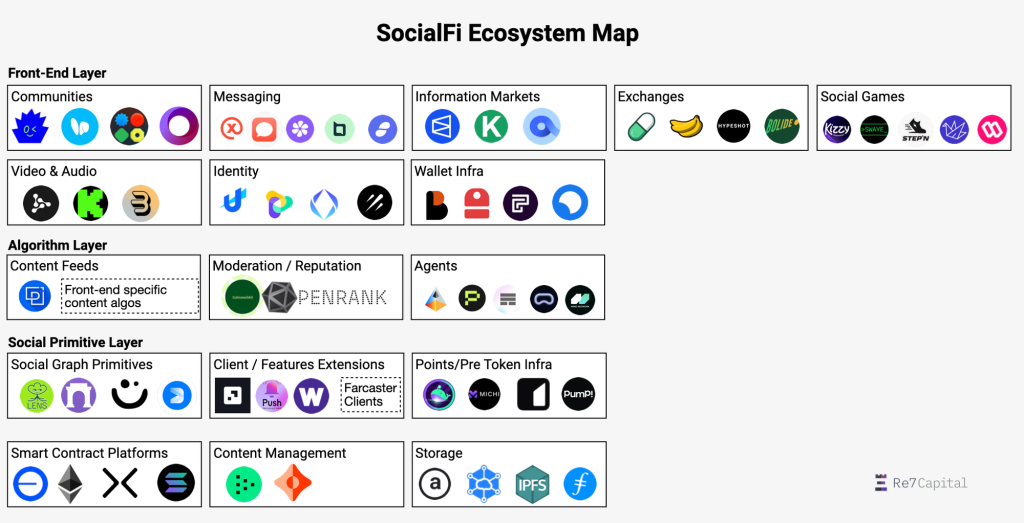

We are also seeing the ecosystems become richer with new and emerging sub-sectors.

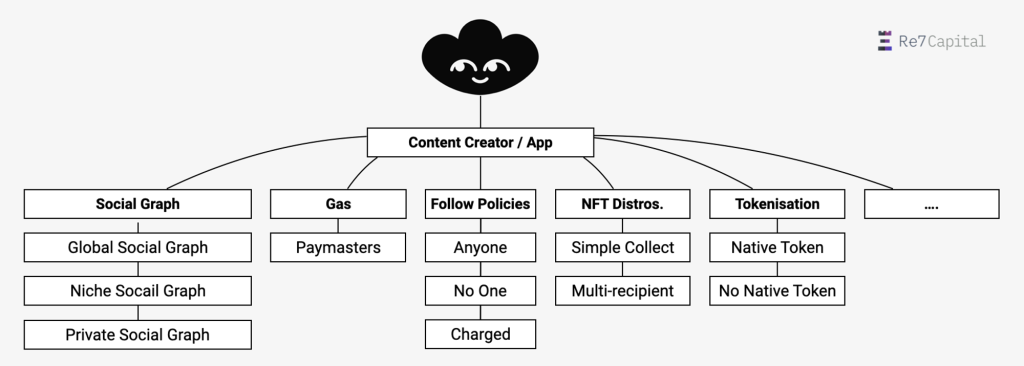

This has been helped by the advent of more modular social platforms like Lens that are seeing applications built on top of them.

Any creator or app developer can fully customise their consumer experience, deciding which parameters to include and which ones to avoid.

Stani, the founder and CEO of Avara, sees customizability as the key enabler for success:

“By providing a permissionless modular design, Lens content creators and developers are fully empowered to innovate. Social experiences can be tailored to theoretically unlimited ways, tapping into ready-made social graphs where desired.”

These applications can improve on legacy models (e.g. messaging) or introduce new social primitives altogether.

For example, a reputation scoring system could be created to incentivise positive engagement within a community, tapping into existing ID authentication layers. For example, a variation of Openrank but has the protocol has interoperability across social graphs and ecosystems.

A privacy-first marketplace to buy/sell social graphs to applications would also help formalise how consumers can monetise their data.

Looking ahead

Realising the future of decentralised social networks will take time. The value of social graphs is built incrementally.

Rome wasn’t built in a day but neither was Twitter.

Yet, the changing of the guard is primed to surprise those not paying attention: DeFi will eventually be intertwined with social. DeFi becomes social and social becomes DeFi.

With that, building upon our beginnings as DeFi infrastructure investors and operators, we are excited to announce Re7’s expansion into SocialFi as the new frontier – we are hiring!

Stay tuned for updates 😉

Thank you to the Lens, Orb, Degen, Proxy Studios, Primitives and time.fun teams for the review and feedback on this post.

Re7 Capital is a leading research-driven digital asset investment firm specialising in Liquid alpha and DeFi yield strategies. We currently oversee and deploy ~$350m of digital assets across various ecosystems. Over the last 3 cycles, we have been at the forefront of the blockchain revolution, providing strategic insights and investment solutions that drive innovation in the crypto space.