The Future of Crypto is Social

In January 2025, a single social media post about the $TRUMP token, launched through a one-click interface on Solana, generated hundreds of millions in trading volume within hours. This illustrates a new paradigm: the near-instantaneous conversion of social attention into financial activity.

This isn’t an isolated case. Across the crypto landscape, the most successful products of the past year share one characteristic: they combine social engagement with financial mechanics.

- Pump.fun generated $500M in fees by making memecoin creation instant and social, with live comments and video streams driving trading activity.

- Polymarket saw $2.5B in trading volume during the US elections by turning social discourse into tradable positions.

- Kaito transformed social influence into direct financial value through their points system, creating a new model for monetizing attention.

The successes share a common pattern: social traction creates attention, crypto rails enable immediate value capture, and the resulting price appreciation amplifies engagement, creating a self-reinforcing cycle. Even institutional adoption follows this pattern. As the asset class grows through social momentum, it becomes acceptable for asset managers to allocate capital and build on crypto rails, creating another loop between social and financial value.

In this piece, we will go over:

- The convergence of social and financial mechanics creates powerful, self-reinforcing loops where attention translates directly into financial value.

- The acceleration the category is undergoing as a result of improved infrastructure, talent inflow, and compounding network effects.

- Our investment thesis focused on three key patterns: friction reduction, atomic value capture, and the rise of consumer studios leveraging tokens as “stores of attention.”

I. Perfect Attention-Value Loops: Why Crypto Social Wins

Crypto social platforms win by collapsing the distance between attention and value capture. Think about how much a single viral tweet with millions of views contributes to X’s revenue or even to the creator. A memecoin backed by the same tweet would likely generate millions in trading volumes within hours, such as $TRUMP and many others in the past year.

This collapse of friction mirrors Las Vegas’s transformation in the 1960s, when casinos replaced mechanical slot machine levers with electronic buttons. That change—shortening the path from attention to action—transformed the economics of the entire industry. Slot machines went from a sideline to generating 70% of casino earnings and remain the core revenue driver for industry leaders. The lesson is that shorter feedback loops between attention and action create dramatically better businesses. The same pattern is happening in crypto social.

This “attention-to-action friction reduction” thesis explains why certain crypto products break out and how they compare to previous social products:

- Memecoins: See something interesting or funny → buy token (1 step)

- Polymarket: Have an opinion on current events → open a position in an opinion market (1 step)

- Twitter ads: See content → watch ads → brand awareness → possibly buy later (many steps)

- Instagram creator: Create content → build audience → set up monetization → pitch products (many steps)

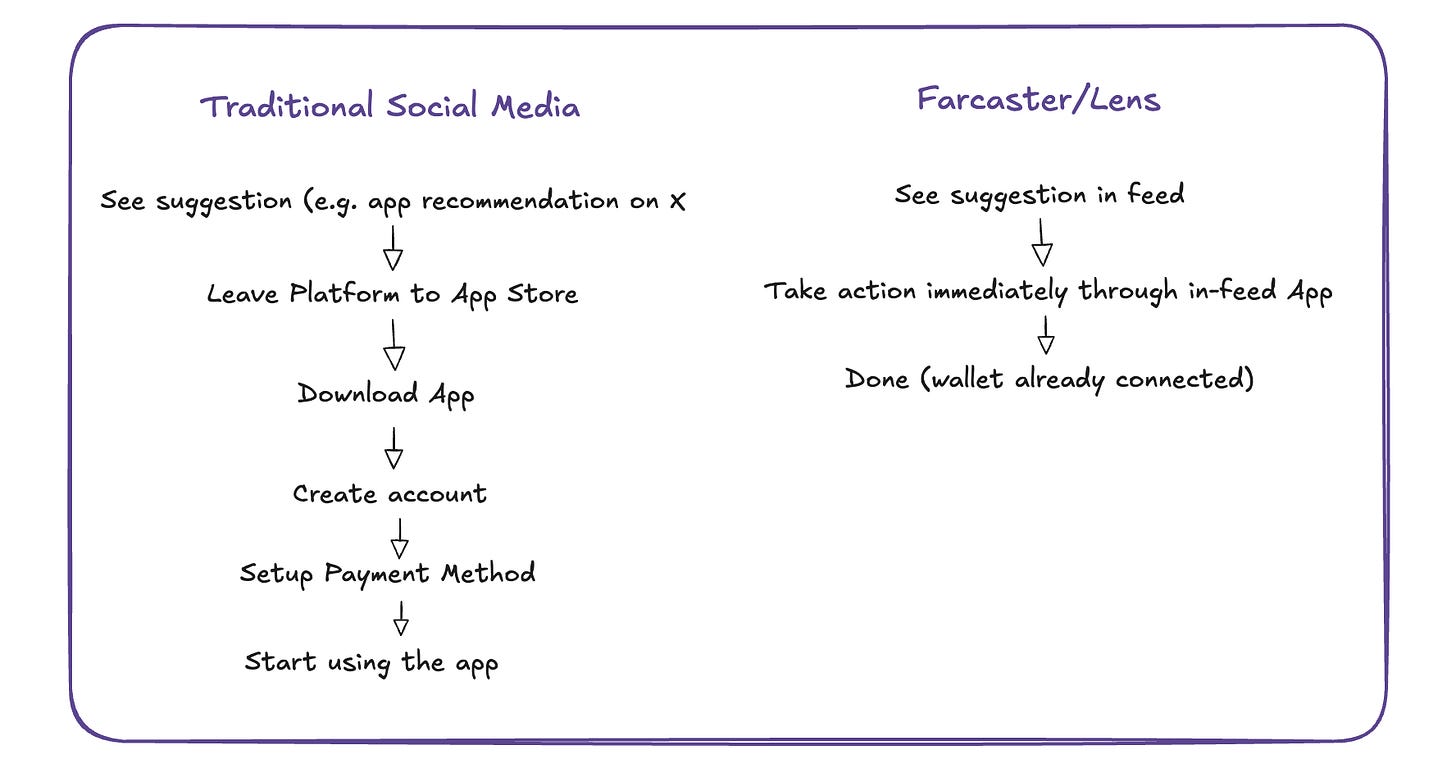

This extends beyond trading. Open social networks like Farcaster, Lens, or Tapestry are built on a common principle: infinite extensibility by third-party developers to build in-feed applications or entirely different clients. The key differentiator is that developers can create applications that users discover and use straight from the feed. It illustrates our thesis as they accelerate the Attention → App Discovery → App Usage → Transactions path.

Historical precedents exist for the value of in-feed apps and developer ecosystems on social networks. One of the fastest-growing applications was FarmVille (an in-app Facebook game), which converted over 20% of Facebook’s user base and generated $235M in its first year 2009. Their acquisition and retention largely relied on social mechanics like leaderboards and gifts/tips among players.

Key properties of crypto social products

Crypto social platforms aren’t just replicating existing models; they possess unique properties that drive their success.

Monetizing in hours vs. months

Unlike traditional social networks built on an internet without native payment systems (what Marc Andreessen calls the “Original Sin of the Internet“), crypto social platforms have built-in payment rails (profiles meet wallets). This compresses the time to value, removing the need to leave the platform, connect external payment systems, or intermediaries. This enables faster feedback loops, quicker iterations, and higher average revenue per user.

TikTok’s success is in part explained by the fact they enabled creators to go viral in hours rather than in months. All of the traditional alternatives required creators to build a large following before they could go viral. But it still takes months to monetize, as the main value capture is ads, which require an audience. Crypto social offer is the ability to monetize these viral moments and capture value in hours rather than months.

This advantage is evident:

- Time to monetization: Hours vs. months

- Revenue per engagement: 10-100x higher than ad-based models.

- Value distribution: Direct creator capture vs. platform mediation

Mutually Reinforcing Network Effects

Traditional platforms benefit from social network effects (Facebook) or financial network effects (Coinbase), but rarely both. Crypto social applications combine these forces and more.

These network effects work on three levels:

- Social network effect: Each new user increases the platform’s value.

- Liquidity network effect: More trading volume enhances price discovery and reduces friction.

- Market reflexivity: Social engagement drives trading activity, fueling more interactions.

This creates a feedback loop: more users attract more traders, increasing liquidity and driving social engagement.

Polymarket’s 2024 election markets illustrate this combination. What began as social discussion around election odds attracted retail traders, creating initial liquidity. This drew in sophisticated traders and institutions, deepening the markets. The improved price discovery then sparked more social engagement, with users sharing insights and analysis. This virtuous cycle drove over $9B in betting volume, with the most active markets matching the most discussed topics on social media.

Key metrics demonstrating this advantage:

- User acquisition cost decreases with scale.

- Liquidity depth is growing faster than user count.

- Cross-platform engagement multipliers.

Native composability

Unlike Web2’s walled gardens, crypto social protocols are open and composable. This allows applications to freely build on each other’s social graphs, financial primitives, and user data—creating exponentially richer design spaces and faster experimentation.

This composability manifests in an experience where actions can happen directly where attention is focused through three key mechanisms:

- In-feed applications: Developers embed complete app functionality directly within the feed.

- Shared profile and credentials: Authentication is handled at the protocol level and shared across applications.

- Built-in payment methods: Users already have connected wallets, eliminating payment friction.

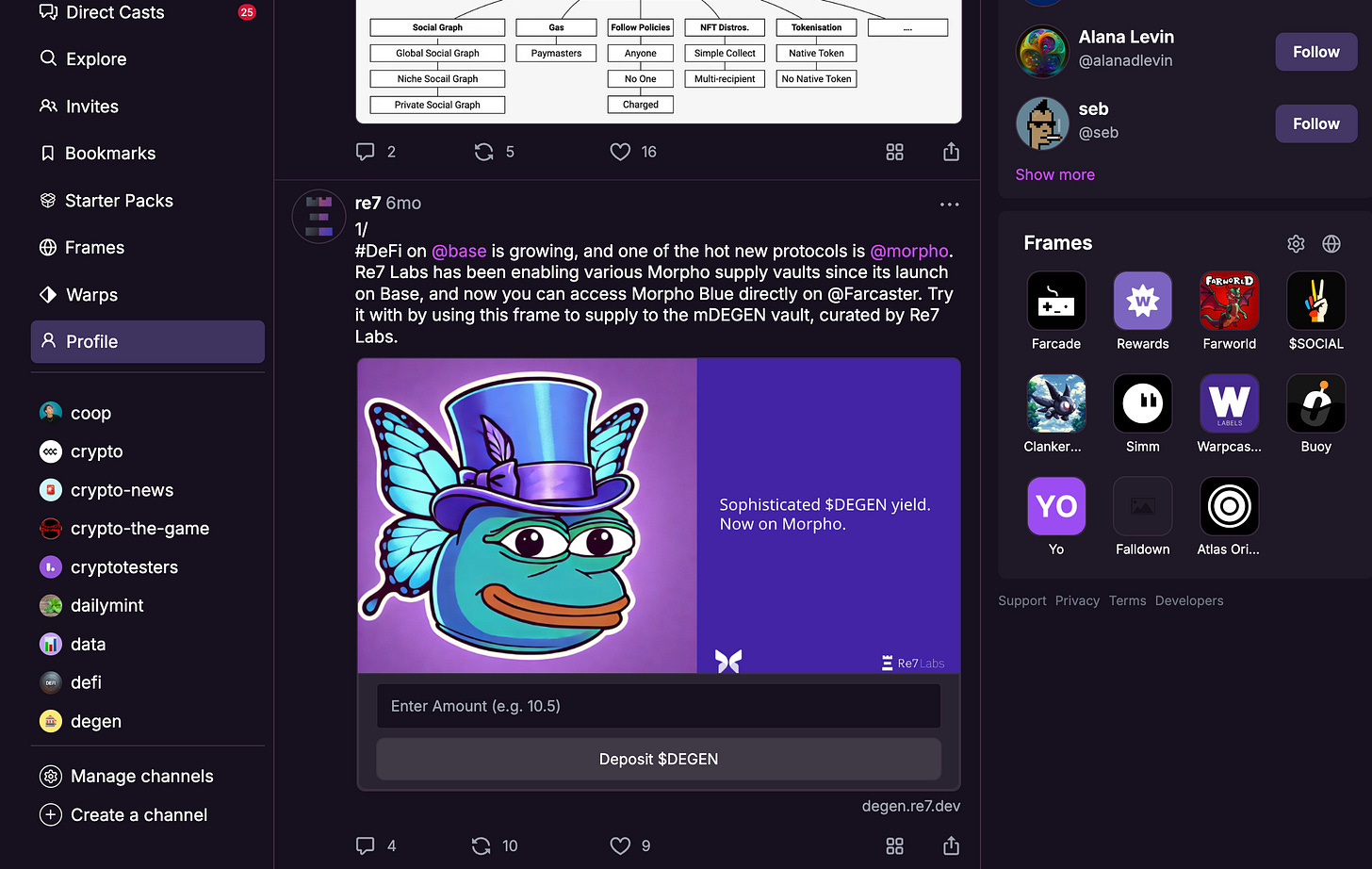

Farcaster’s frames exemplify composability. These in-feed mini-apps enable one-click trading or investment. Re7 built one of the earliest frames to turn a social post into a direct investment opportunity.

These three properties—instant value capture, mutually reinforcing network effects, and native composability—create the foundation for crypto social’s success. But right now, we’re hitting an important inflection point that makes this category particularly compelling.

II. Why This Will Accelerate

The core properties of crypto social platforms have always been compelling. However, until recently, two critical barriers held the category back: user friction and distribution challenges. Three major developments in the past 24 months created an inflection point.

The infrastructure approaches consumer-grade

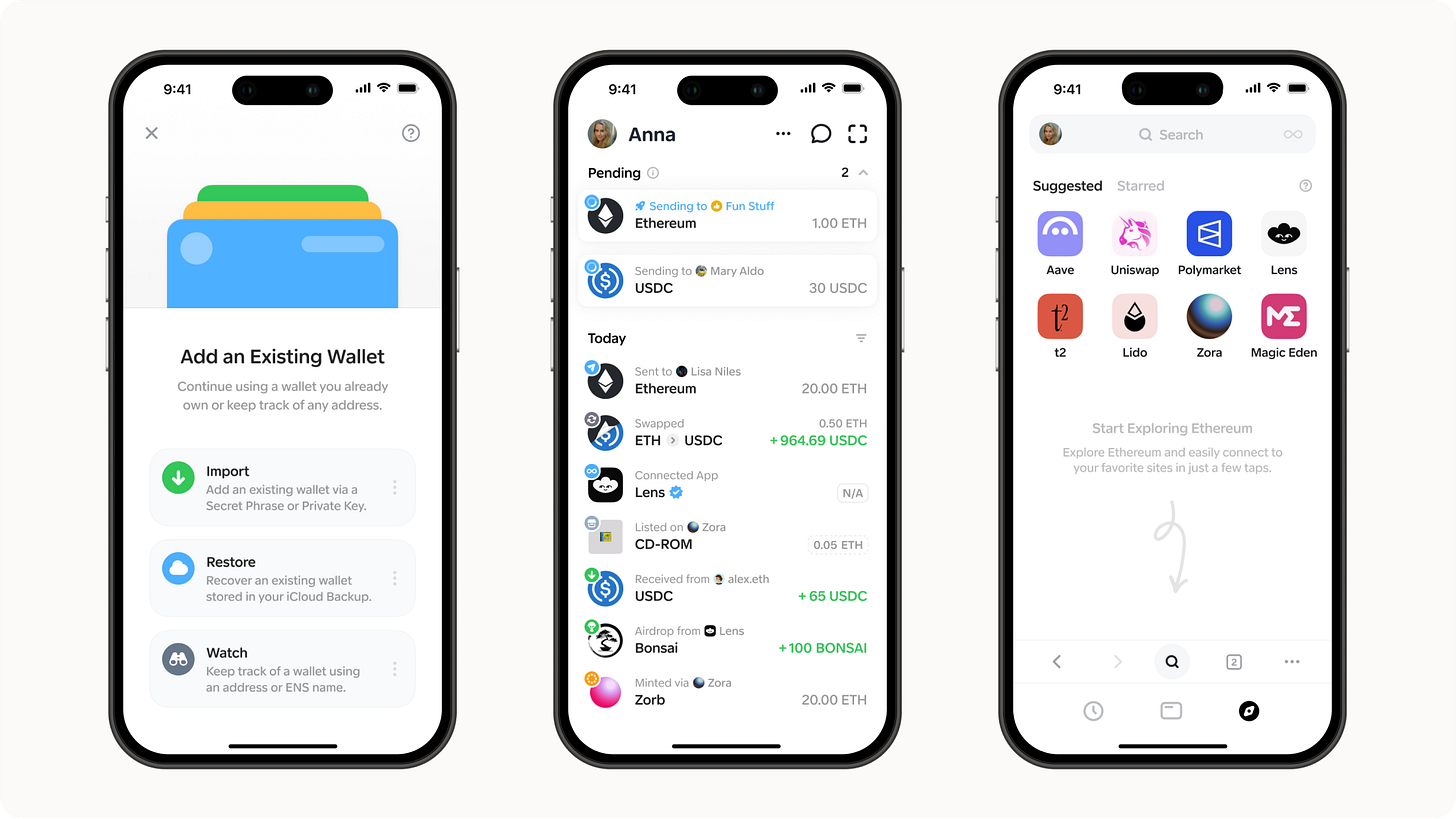

After years of complexity, crypto infrastructure has become much more user-friendly.

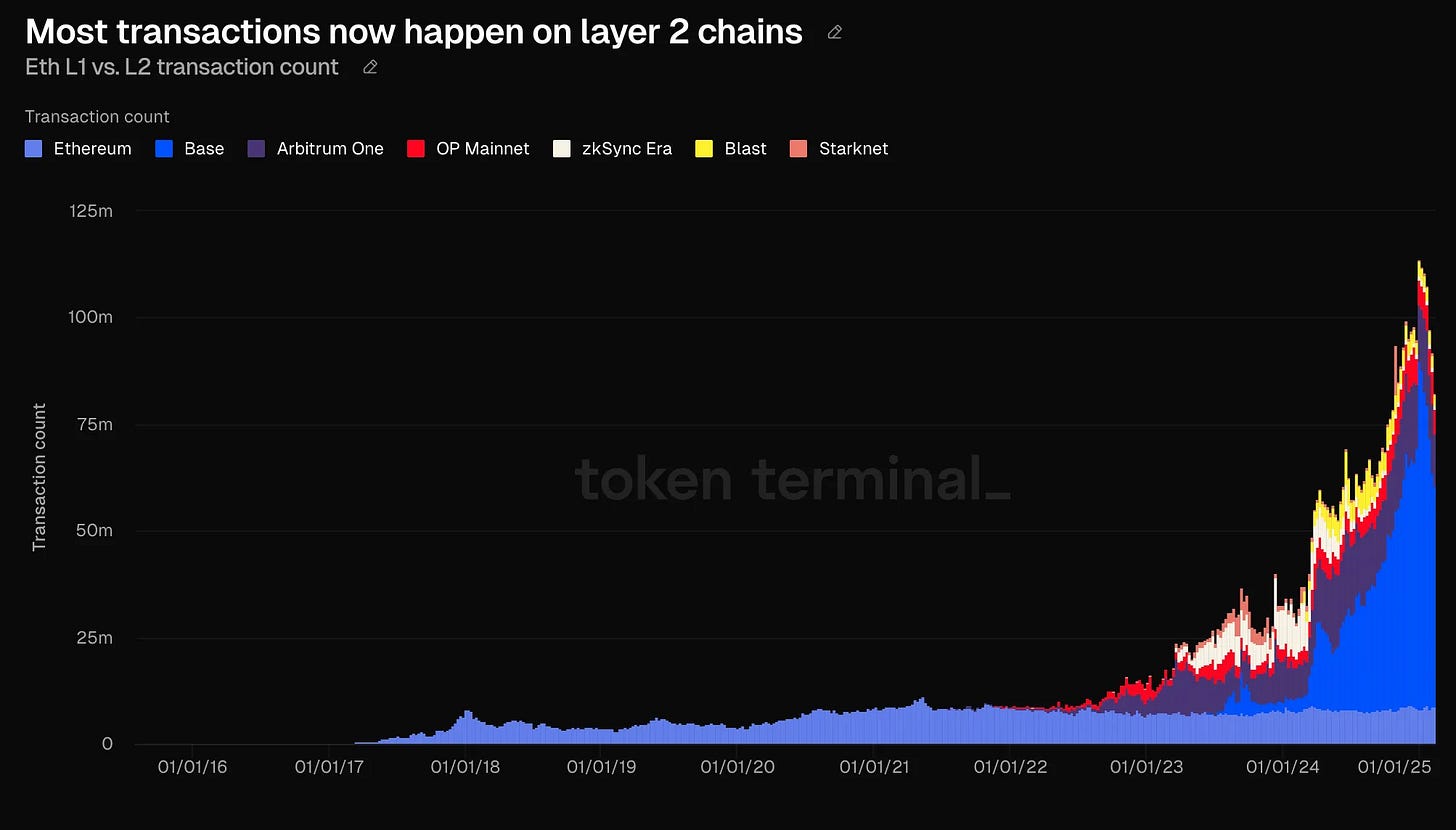

First, blockchain infrastructure approaches consumer grade. What used to cost $50 in transaction fees can now be done for cents, or absorbed by applications. Layer-2 Ethereum scaling solutions are processing transactions at an accelerating rate, bringing down costs by one or more orders of magnitude. The dramatic reduction of the industry’s major cost will impact the kind of applications built on crypto rails.

It’s not just costs; the user experience has also improved. Gone are the days when any crypto app required a 30-minute onboarding process of creating a wallet, saving seed phrases, and buying ETH or SOL. Account abstraction and social logins mean new users start with just an email or existing accounts. That reduces time to first transaction from 20+ minutes to under 60 seconds. In consumer, nothing beats time to value and virality potential.

The second breakthrough is the emergence of open social graphs with genuine engagement. Farcaster, Lens, and others have built crypto-native social networks with primitives for founders to use out of the box, and an existing user base to top into (nearly 2M users in 12 months, or a 30-40% DAU/MAU ratio on Farcaster).

But infrastructure only matters if it attracts high-quality builders.

High-quality teams building full-time

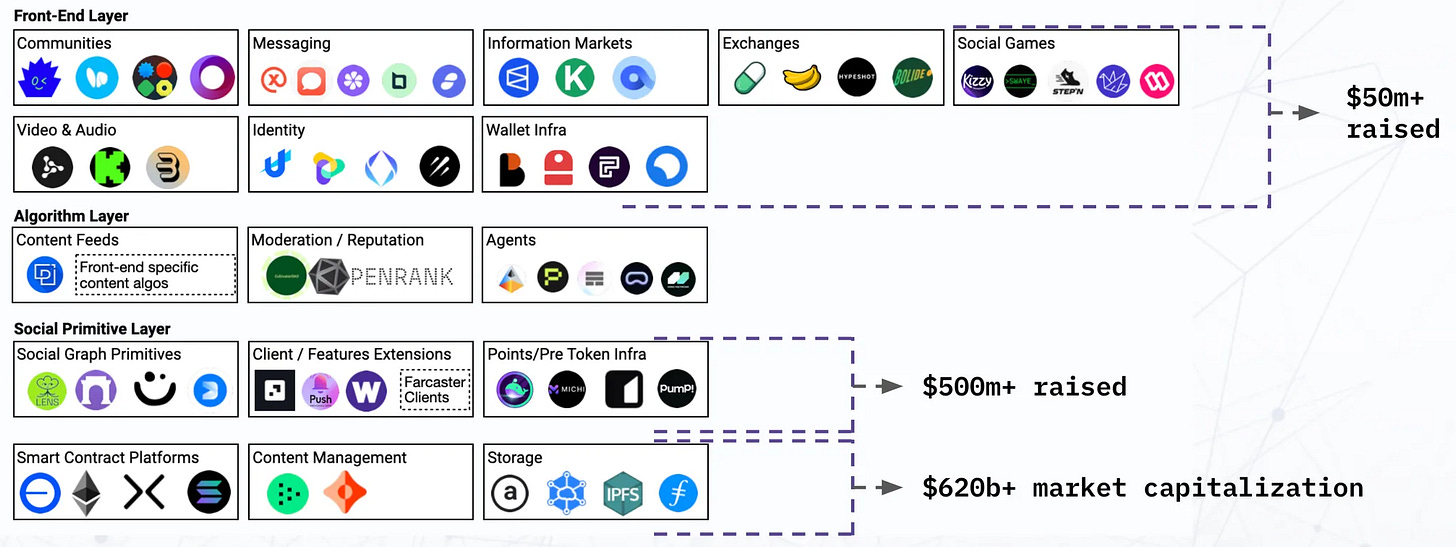

The quality of teams building in an ecosystem is the strongest signal of its maturity. In the past 12 months alone, we’ve tracked 150+ teams building social applications on open protocols. It’s notable because they’re choosing this path with limited token incentives, grants, or immediate revenue potential.

Some of the best talent in the space is coming to crypto social, like the Neynar team whose founders built Facebook Messenger, Microsoft Teams, and Coinbase Earn. They’re building infrastructure for crypto social. Another is the ex-Mirror team who dropped everything to build a Farcaster client. Or the former head of OpenSea’s protocol development building a Farcaster client.

The venture ecosystem has noticed: recent rounds in the Farcaster ecosystem alone include Neynar raising $11M from Andreessen Horowitz, Haun Ventures, and USV. Or Kiosk securing $10M from a16z, USV, and Variant. While infrastructure plays have traditionally captured the majority of crypto venture dollars, there’s a shift in capital allocation toward social applications – capital and talent are coming together to support what can be the largest outcomes in the space.

Accelerating Flywheel

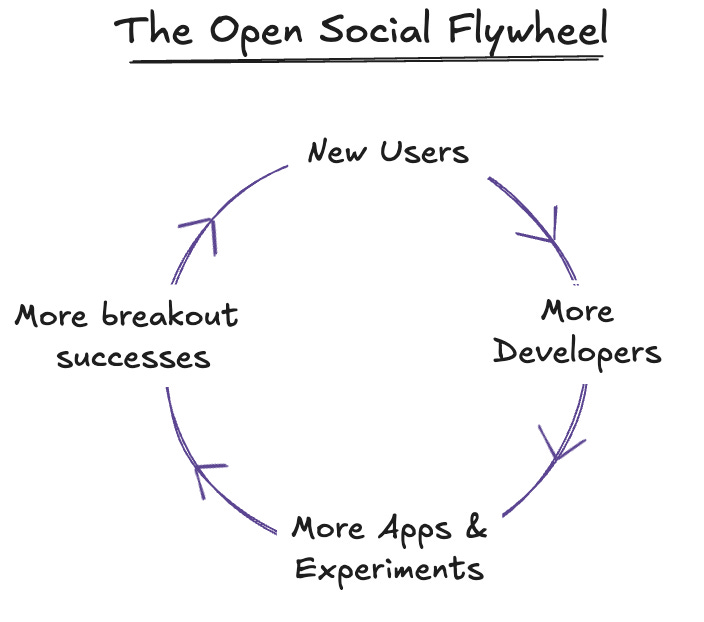

Developers are motivated to bet on open social protocols due to easy access to their engaged users. They are typically eager early adopters of crypto products with significant capital. This attracts developers and leads to iterations and experiments, with some of them becoming notable successes.

One such example is Degen, a tipping mechanism and community that launched in January 2024 (which we invested in early) and rapidly grew to a $2B valuation at all-time-high and over 1M strong holder community. A lot of these ended up becoming Farcaster users too and going to other applications and communities.

This creates a rapidly accelerating flywheel due to multiple experiments and applications built for this audience. Some break out and go viral, leading to new user inflows to the protocol, and a shared success effect where these new users become available to all other applications built on the protocol. This in turn makes it more attractive for new developers to build for this enlarged audience.

These are strong network effects. Each new user makes the platform more valuable for developers, each new developer increases the chances of breakout successes, and each breakout success brings more users. The flywheel accelerates with each turn.

Our initial investments and early research reinforced our conviction that this inflection point presents a rare opportunity for strategic capital deployment, and to work alongside the companies that will define the category.

III. The Investment Playbook

The convergence of improved infrastructure, quality teams, and compounding network effects creates a unique window of opportunity to invest in the category leaders of this emerging space. Our investment thesis focuses on three key patterns defining the winners in crypto social. We want to back networks and products at war with friction, that capture value atomically, and adopt a studio mindset for product iteration.

The war on friction

This entire thesis makes the case that the biggest opportunities are products that remove friction points that prevent immediate action from attention. Success comes from eliminating steps between interest and action.

For any new crypto social project, we ask:

- How many steps are there between attention and transaction?

- How many parties need to be involved?

- How quickly can value be captured once attention exists?

- What are the technical and UX friction points in the value capture loop?

This idea isn’t new. Traditional e-commerce companies know that even minor friction can dramatically reduce conversion. A great example is Apple Pay – making the flow smoother doubled conversion rates and increased checkout speeds by almost 60%.

Crypto social is uniquely positioned because crypto at the limit can ensure an almost frictionless experience. The combination of instant value transfer on built-in payment rails, linked to social profiles, on open protocols makes it possible to approach the “friction zero” state where attention and value transfer are essentially the same action.

Atomic value capture

The second pattern we want to see is strong ties between virality and value capture. Specifically, we want to see viral growth mechanisms that capture value directly, unlike traditional social where virality benefits a platform but value capture is indirect.

A common pattern in social products like BeReal or Clubhouse is that they go massively viral but struggle to translate that attention into revenue. By the time monetization kicks in, the viral attention has often faded. It leads to a scenario of high user numbers, but little actual value captured. It’s like trying to take a photo of a lightning strike: when you get your camera out, you’re already late.

The better option is to be set up from the beginning with a way to capture the energy from the lightning or to come up with radically new ways to capture value at the point of attention/transaction. We’ve seen ——examples of new ways to create value:

- Monetize trading fees: token launchers like Clanker or Flaunch create new ways to launch assets and monetize by taking a share of trading fees. When a token goes viral, revenue ensues.

- Bonding curves: pricing assets on a bonding curve is a mechanic that reflects attention dynamics naturally. Pricing assets on a bonding curve avoids the liquidity problem and rewards early participants, the creator, and the protocol.

- Market creation fee: captures fees from market creation. This generated $500M in fees for Pump.fun. The mechanism incentivizes market creation, ensures quantity, and collects a fee.

Consumer studios with ‘store of attention’ tokens

In consumer, a reproducible testing process is more valuable than any single idea because all things being equal, a team with more shots at bat will win against a team with an ambitious vision. Historically, companies that understood this pattern built systems to maximize their shots on goal like Zynga with their engine for rapid game testing and scaling or Supercell’s famed “kill fast” approach to game development.

We look for companies that can run an even more powerful version of this model:

- Build infrastructure to capture value at the moment of value creation.

- Rapidly run multiple social experiments.

- When something goes viral, capture value atomically.

- Each success strengthens the shared base and funds more experiments.

In this path, the objective is to create a series of smaller transient hits that may capture attention fleetingly but can capture value sustainably. This mirrors successful venture or gaming studios, and we believe crypto enhances the economics of this model.

The main reason is that crypto can capture value atomically, as exposed above, and offers tools to overcome the cold start problem. The first tool is native composability: by using the same protocols, a user joining a new social app brings an existing profile and social graph. The second is tokens, which we can think about as a “store of attention.”

A great example is Pudgy Penguins. They used successive drops or experiences to direct users to new products and generate revenue. Their initial 8,888 collection was followed by Lil Pudgies, a game (Pudgy World), a memecoin (Pengu), and an entire blockchain ecosystem (the Abstract Chain). The team holds the asset owners’ attention and directs it to each of their new product launches.

Tokens can also be used as a “store of attention” in products around a trending financial asset, like BonkBot. The Telegram trading bot was created by the Bonk memecoin team on Solana. It grew to represent 70% of the token trading volume, and since its August 2023 launch, it generated over $100m in revenue.

IV. Conclusion: The Perfect Storm

The convergence of crypto and social isn’t just another trend—it’s a fundamental shift in how value is created and captured on the internet. We’re witnessing the emergence of platforms that radically accelerate the time and magnitude of attention monetization, supported by ready infrastructure for mainstream adoption, and driven by high-quality teams.

The last time we saw the same combination of infrastructure maturity, talent inflow, and experimentation was in 2019, ahead of DeFi summer. We believe the next wave of asymmetric outcomes will be built at the intersection of social engagement and financial mechanics. The winners will be teams that can reduce friction between attention and action, capture value atomically, and iterate rapidly through a studio approach.

If you’re building in the space, reach out!